Darth Maul

Bitcoin Turning to the Dark Side

Bitcoin made history this week with the USD exchange rate surging to $100,000 per coin!

Bitcoiners around the world were celebrating, up until the price flash crashed in minutes down below $92,000 on most exchanges the following day with a swift recovery, creating the “Darth Maul” daily candle.

Now, if you are a bitcoin veteran, this kind of swingy price action is normal during bitcoin bull markets, but it may seem scary for newcomers who are not used to this kind of volatility.

I remember the first time I saw Darth Maul reveal his double-sided red lightsaber in The Phantom Menace, and I was taken aback, and I bet Qui-Gon and Obi-Wan were too.

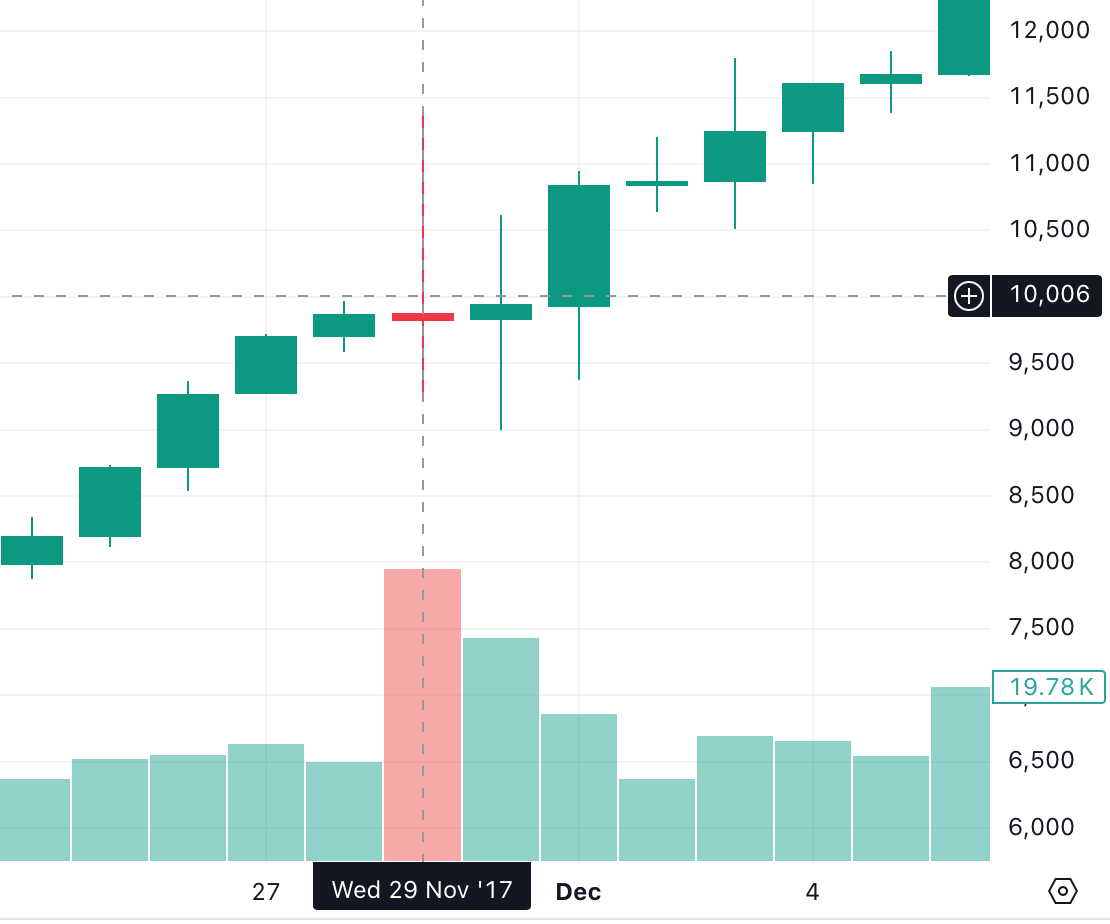

But, I want to point out that Darth Maul candles have happened for bitcoin before, specifically here when bitcoin first broke the $10,000 price point in November of 2017, the last time bitcoin added another zero:

Following the breakout above $10,000, bitcoin went up to $11,000 before going back down below, then continued its way upward through December.

Now, I could find every Darth-Maul candle in bitcoin’s history, as there are many, but let’s talk about why I expect these kinds of daily price moves for bitcoin moving forward.

While there are people like me that buy spot bitcoin no matter the price action, some cryptocurrency exchanges let their users trade with leverage.

Leverage means that you are entering positions with borrowed money, but you are taking significantly more risk because if the price of the underlying asset drops too much, your position gets liquidated and you lose everything.

When bitcoin rallied above the $100,000 price mark, many retail traders opened leverage long positions on bitcoin.

As bitcoin went back down into the $9x,xxx price range, short-term spot selling caused a cascade of leverage long liquidations, with 163,587 traders suffering over $900 million in losses according to Coinglass, with 80% of the positions long.1

The lesson? Don’t play with leverage.

It’s high risk, and gambling.

When it comes to trading bitcoin, you won’t win.

Stick to a dollar-cost average strategy if you are new to bitcoin, and don’t let the volatility scare you.

Bitcoiners who have bought spot bitcoin consistently have been winning.

Riding bitcoin's wild price swings is like piloting the Millennium Falcon through an asteroid field—chaotic, unpredictable, and not for the faint of heart. Yet, just like Han Solo, seasoned bitcoiners know that with enough grit and faith, they'll navigate the turbulence and come out the other side, engines roaring, ready for the next adventure.

A long leverage position means that you are betting that the underlying asset’s price will increase, while a short leverage position means the opposite. Short liquidations cause price liquidations to the upside, which also commonly occur in bitcoin’s spot price history.